加群或其他问题可扫二维码添加阿瑟

加群或其他问题可扫二维码添加阿瑟

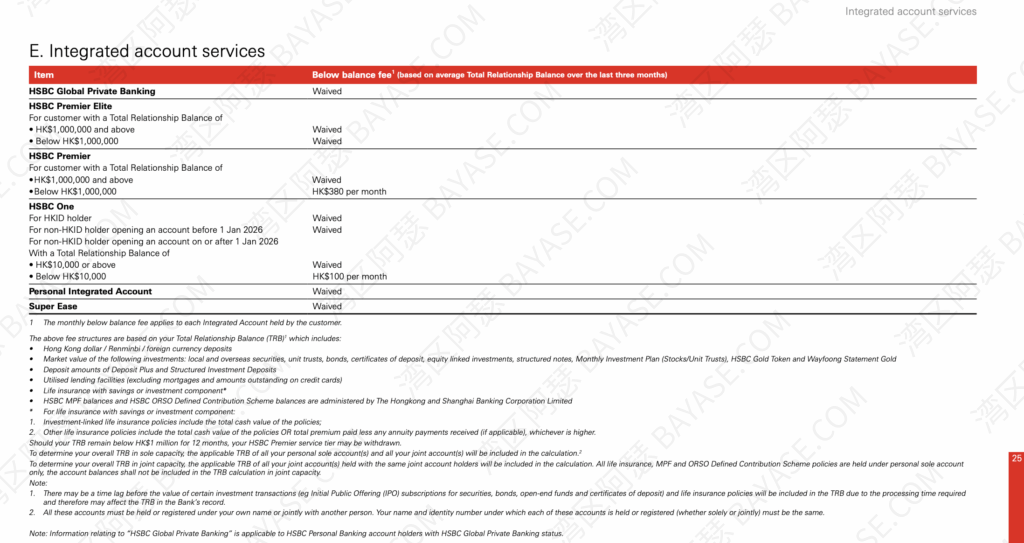

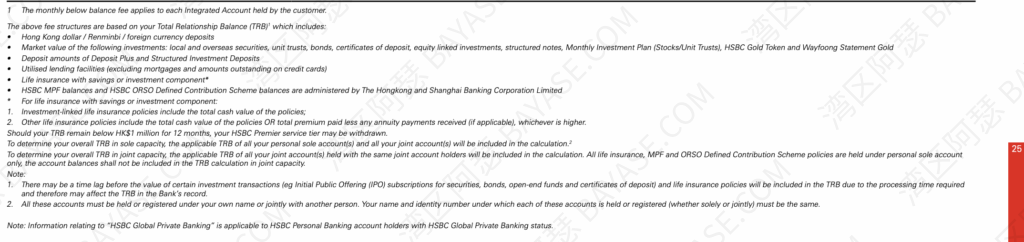

Overview of HSBC management fees, including HSBC One account fee rules, monthly charges, exemption conditions, and how asset levels affect account management fees in Hong Kong.

Recently, HSBC Hong Kong released an updated official document outlining changes to its personal banking service fees, including an adjustment to the HSBC One account fee, which has drawn significant attention from users.

This move is particularly noteworthy because it marks one of the rare instances in recent years where a low-threshold Hong Kong bank account is reintroducing a management fee. It may also signal a broader shift in Hong Kong banking policies, especially for non-local customers.

In previous articles, HSBC One had long been one of Arthur’s most strongly recommended Hong Kong bank accounts. However, with the introduction of a management fee, this update has come as a surprise to many.

Related reading:

[Hong Kong Bank Account Opening Guide] How Can Mainland Chinese Open a Hong Kong Bank Account? What Are the Requirements for HSBC and BOCHK?

According to HSBC’s official document, “Guide to HSBC Wealth Management and Personal Banking Service Fees”, the following changes apply:

Starting January 1, 2026, HSBC One accounts newly opened on or after this date will be subject to a management fee if all of the following conditions are met:

In such cases, HSBC will charge:

HKD 100 per month as an account management fee

No.

HSBC One accounts successfully opened before January 1, 2026 will continue to enjoy fee exemption, even if the account balance is low. This exemption is clearly stated in HSBC’s official documentation.

Under HSBC’s definition, Total Relationship Balance refers to the customer’s overall assets within the HSBC ecosystem, not just the cash balance of a single account.

It typically includes:

In short, HSBC looks at your total financial relationship with the bank, not just one account’s cash balance.

The reason is simple:

HSBC has long been a policy bellwether in Hong Kong’s banking sector.

Years ago, HSBC was among the first major banks to remove management fees for low-tier accounts. Following this move, other banks such as BOC Hong Kong, Hang Seng Bank, and Standard Chartered gradually followed suit, shaping today’s environment of low-entry, fee-free Hong Kong bank accounts.

Now, once again:

HSBC is the first to reintroduce fees for low-asset accounts.

This naturally raises concerns such as:

At the time of writing, no other banks have announced similar changes. However, this update clearly sends a signal worth monitoring.

While most attention is currently focused on the HSBC One management fee, HSBC has always applied different fee structures across different account tiers. HSBC One is simply the most visible change at this stage.

In general, HSBC’s account structure follows a clear logic:

A simplified comparison of HSBC account types:

This explains why the HSBC One fee adjustment has triggered so much discussion—HSBC One has long been regarded as the lowest-barrier account, particularly suitable for everyday users and non-local residents.

From a business perspective, this is not unexpected:

This adjustment appears to be a targeted screening of low-asset, low-usage accounts, rather than a blanket price increase.

From a practical standpoint, the impact is mainly reflected in the following areas:

For non-HKID holders who only intend to:

The cost-effectiveness of a new HSBC One account will clearly decline after 2026.

Although this change currently affects only HSBC One, it reflects a broader trend:

If you already hold an HSBC One account opened before 2026, its fee-free status could become increasingly valuable in the future.

At present:

Whether management fees will be broadly reinstated across Hong Kong banks remains something to watch closely.

All information above is based on HSBC’s official publication:

“Guide to HSBC Wealth Management and Personal Banking Service Fees”

Official PDF document:

https://www.hsbc.com.hk/content/dam/hsbc/hk/tc/docs/ways-to-bank/bank-tariff/20260101-guide.pdf

If you are considering opening a Hong Kong bank account, timing and account selection may now be more important than ever.

HSBC Hong Kong applies different management fees depending on account type. Fees may apply if asset or usage thresholds are not met.

For accounts opened on or after January 1, 2026, management fees apply if the relevant conditions are met.

No. Accounts opened before January 1, 2026 remain fee-free.

HKD 100 per month, if the charging conditions are met.

Possible reasons include rising operational and compliance costs, resource usage by low-balance accounts, and overall client structure optimization.

Common approaches include:

1. Opening the account before 2026

2. Maintaining sufficient Total Relationship Balance

3. Choosing a Hong Kong bank account type that better fits your needs

That's the end — thanks for reading!

Here are some communities created by Arthur. Feel free to join if you're interested:

The Telegram groups have fewer chat restrictions. Just add the bot and select the type of community you'd like to join:

You can also add Arthur as a Telegram contact:

Connect with Arthur and stay closer.

Disclaimer: The content of this article reflects personal opinions only. Any financial actions taken based on this information are at your own risk, and any resulting losses shall be borne solely by the operator.