加群或其他问题可扫二维码添加阿瑟

加群或其他问题可扫二维码添加阿瑟

A complete 2025 DogPay guide covering virtual cards, budget vs stored-value cards, US bank accounts, Apple Pay/Google Pay support, fee structure, and USDT/USDC merchant collection. Learn how DogPay helps freelancers, digital nomads, and global users manage cross-border payments and digital asset transactions efficiently.

DogPay has rapidly grown into a popular tool for users who need to make international payments, open virtual cards, subscribe to overseas services, bind Apple Pay or Google Pay, or receive payments in USDT/USDC. As cross-border finance and digital assets continue to expand, DogPay stands out by integrating multiple financial functions into a single platform.

This comprehensive guide will walk you through all aspects of DogPay—from its wallet system, virtual cards, card segment differences, fee structure, supported regions, U.S. banking features, to its crypto collection system. Whether you're a digital nomad, freelancer, cross-border entrepreneur, or someone who simply wants to access international services, this article will help you master everything DogPay can do.

DogPay is a versatile financial platform that combines a virtual card system, crypto wallet, U.S. bank account, and digital asset merchant collection system.

Unlike typical virtual card providers, DogPay supports both payment and digital asset collection, making it suitable for both personal and business use.

DogPay consists of four major modules:

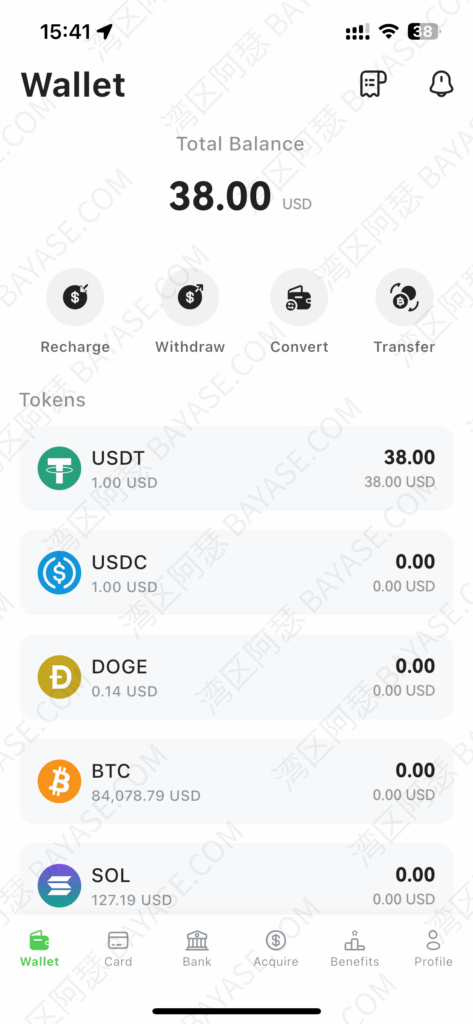

DogPay wallet supports:

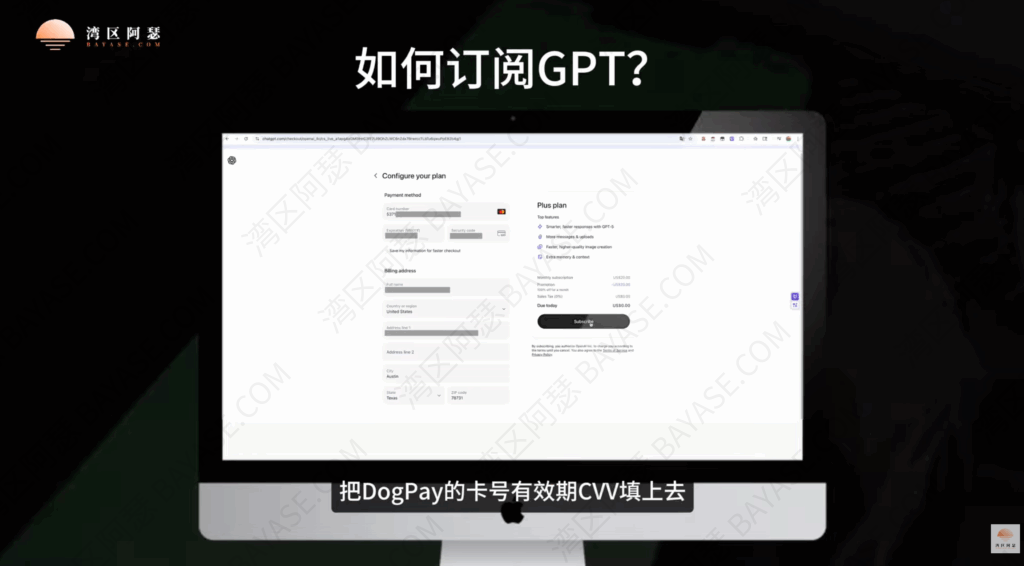

DogPay’s virtual cards are widely used for:

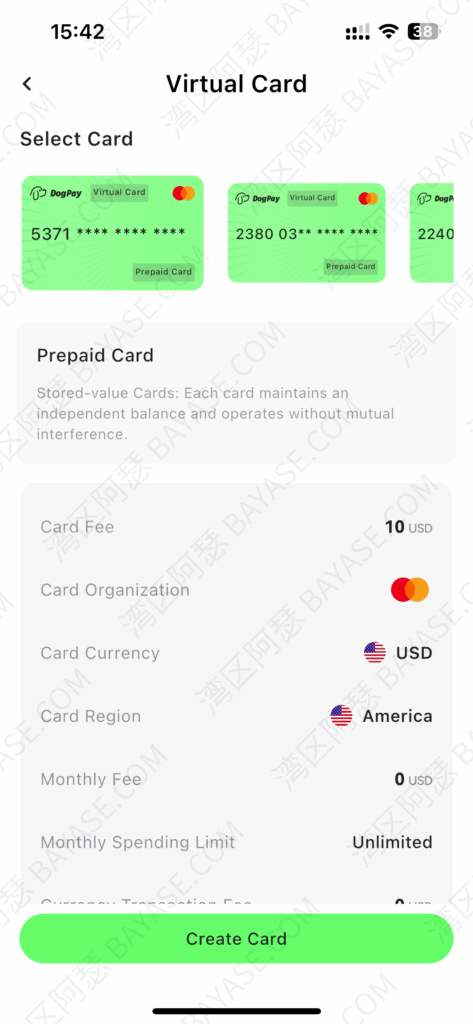

DogPay offers three BIN segments with different features:

| BIN | Region | Apple Pay | Google Pay | Best Use Case |

|---|---|---|---|---|

| 5371 | US | Yes | Yes | Subscriptions & global payments |

| 2380 | UK | No | No | Online transactions |

| 2240 | Hong Kong | No | No | Pure online payments |

| BIN | US Region | Non-US Region |

|---|---|---|

| 5371 | $0.50 | $0.50 + 1.5% |

| 2380 / 2240 | $0.30 | $0.30 + 1% |

DogPay includes a U.S. personal checking account, which supports:

This feature is especially valuable for freelancers and digital nomads.

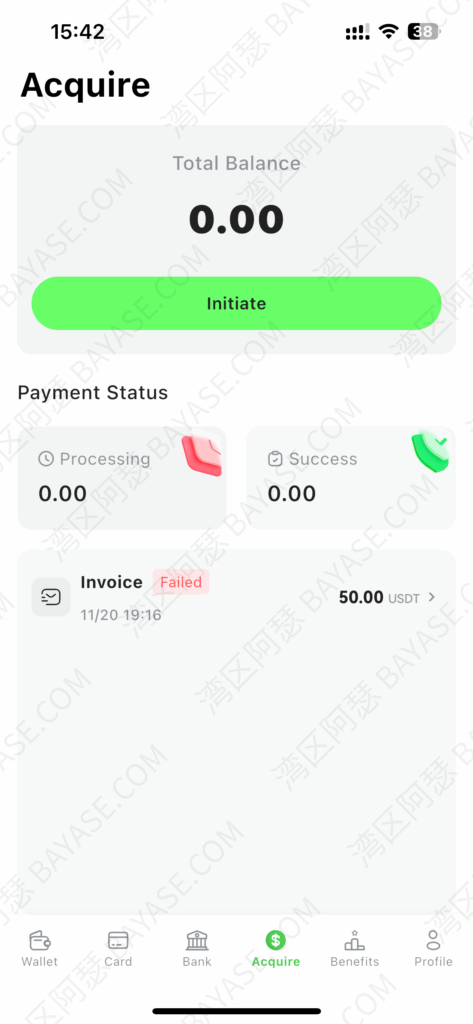

DogPay offers two methods for collecting crypto payments:

Such as:

Only 5371 is fully compatible.

Extremely practical for remote workers.

DogPay implements multiple security systems:

DogPay offers a high level of security among virtual card platforms.

Make sure to read my previous article too — it includes more useful tips you might find helpful:

《DogPay Virtual Card Review: Cheapest Wildcard Alternative for ChatGPT, Apple Pay, and Alipay》

A1: Yes. DogPay applies multi-layer security, transaction encryption, fund segregation, and advanced risk-control systems to ensure the safety of user transactions and balances.

A2: The 5371 US BIN is the most recommended because it supports Apple Pay and Google Pay and has the highest acceptance rate across global payment platforms.

A3: Yes, but support depends on PayPal’s regional policies. In many regions, the 5371 BIN can be successfully linked.

A4: Yes. Most international digital platforms accept DogPay cards, with the 5371 BIN offering the highest success rate.

A5: Yes. DogPay supports withdrawals in USDT, USDC, and other supported crypto assets across multiple networks.

A6: Some functions—like banking or merchant collection—may require KYC. Virtual card usage may vary depending on policy.

A7: Yes. Budget Cards do not charge a top-up fee, while Stored-Value Cards require a 1% top-up fee.

A8: Yes. Budget Cards allow unlimited virtual card creation since they share a central balance pool.

A9: Yes. Conversion fees depend on the card BIN and the region where the transaction occurs.

A10: Absolutely. DogPay is excellent for receiving USDT/USDC payments, paying for international services, and managing cross-border financial operations.

That's the end — thanks for reading!

Here are some communities created by Arthur. Feel free to join if you're interested:

The Telegram groups have fewer chat restrictions. Just add the bot and select the type of community you'd like to join:

You can also add Arthur as a Telegram contact:

Connect with Arthur and stay closer.

Disclaimer: The content of this article reflects personal opinions only. Any financial actions taken based on this information are at your own risk, and any resulting losses shall be borne solely by the operator.