加群或其他问题可扫二维码添加阿瑟

加群或其他问题可扫二维码添加阿瑟

Learn how to make a cross-border transfer from Bank of China Mainland to UK iFast Bank in 3 easy steps. Step-by-step guide, fees overview, and tips for smooth international remittance.

If you want to make a China Bank cross-border transfer to the UK, this guide will show you how to do it easily in three steps. Many people need to make international transfers, such as paying tuition fees for studying abroad or handling business expenses, but may be using the service for the first time and are unfamiliar with the process, worried about mistakes causing losses.

Actually, domestic remittance to overseas is quite convenient. The main limitation is that each person has an annual foreign exchange purchase and settlement quota equivalent to USD 50,000, and this limit is calculated by the calendar year.

For example, if you have never used foreign exchange purchase and settlement before, and you buy USD 50,000 on December 31 this year, then on the next day, January 1, you will have another USD 50,000 quota.

This explanation makes it easier to understand.

Now back to today’s topic: using Bank of China Mainland to make a foreign exchange purchase once and remit to UK iFast Bank.

Next, I (Arthur) will demonstrate the process step by step:

Overall, it’s actually a three-step process.

The first step is to purchase foreign exchange, that is, spend RMB to buy the currency to be remitted. Here I am remitting to the UK, so I choose GBP, but USD is also acceptable; there is no rule that the destination country dictates the currency.

The second step is to fill in remittance information, including two parts: the remitter’s information and the recipient’s information. The remitter’s information is simple, but the recipient’s information requires a detailed address and a reasonable remittance reason.

After completing the first two steps and submitting, the third step is simply to wait for the funds to arrive.

Now let’s go through the detailed steps.

Open the “Bank of China APP”. If you are using other bank apps, the operations are basically similar. Then search for “结售汇” (Foreign Exchange Settlement and Sale), find the purchase foreign exchange option, read the agreement briefly, then enter the amount to purchase and select cash or telegraphic transfer.

The difference between cash and telegraphic transfer is simply whether you want to withdraw physical cash. If you are traveling and need cash on hand, choose cash; if you only need to purchase online or remit directly, choose telegraphic transfer.

Of course, this is a simplified understanding; the actual concept is more complex.

Additionally, select the purpose of foreign exchange purchase. Usually, fill in truthfully. Here I plan to remit 100 HKD to the UK to buy GPT membership, so I select “Overseas Shopping”.

The purchase purpose should match the remittance purpose later. If not, there may be special cases, which will be explained later. The impact is not significant.

Confirm the amount to purchase, remember it is the remittance amount, not the RMB value.

After confirming, submit and then click Cross-Border Remittance to enter the remittance process. If you can’t find it, search from the homepage again.

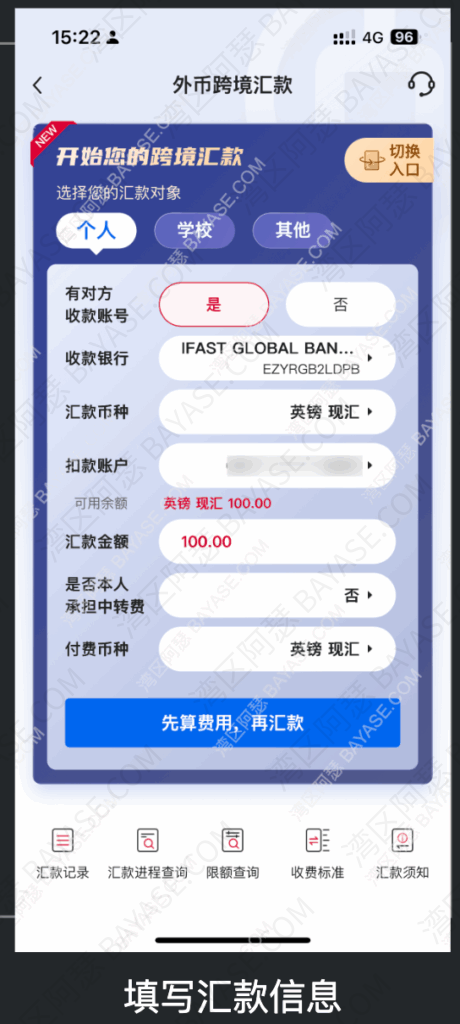

As usual, read and agree to the agreement, then select the recipient. Here I am transferring to my own account, so I choose “Individual”.

For the receiving bank, if remitting to an overseas Bank of China, choose “Overseas Bank of China”; here I remit to iFast, so I choose “Overseas Other Bank”.

You can see SWIFT code and other information are required. These can be found in the recipient bank’s app or provided by the recipient.

Here I take iFast Bank as an example:

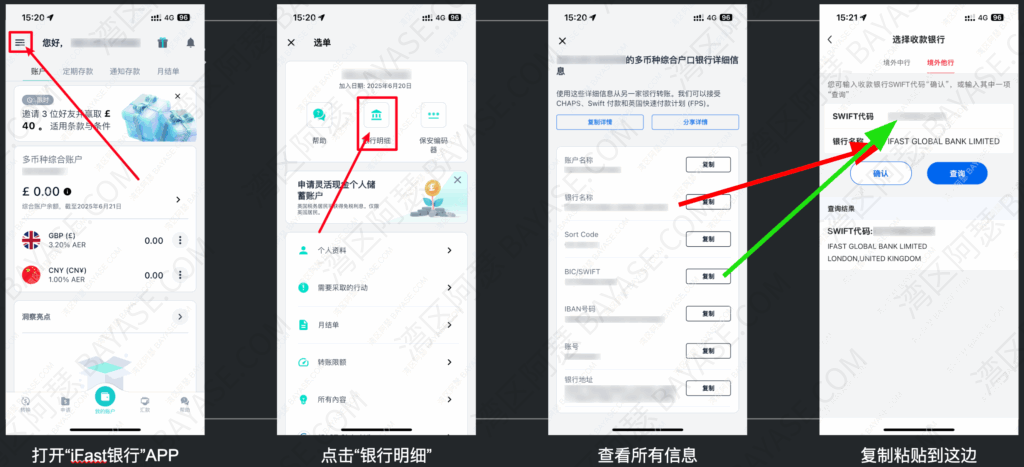

First, open the “iFast Bank” APP, find Bank Details, then copy the Bank Name and BIC/SWIFT into the corresponding fields.

Click query, and you will see the information is correct. Click the query result to select, then fill in other details.

Choose GBP telegraphic transfer for currency. The debit account is usually selected by default. Enter the remittance amount purchased earlier.

Important: “Whether the sender bears intermediary fees.” If “No,” the recipient pays, usually deducted from the remittance amount. If “Yes,” you pay the fee yourself, and the recipient receives the full remittance amount.

After filling in information, click Calculate Fee, Then Remit to see estimated fees.

Fees include three types: service fee, telecommunication fee, and cash/transfer difference. Usually, the first two apply, unless the bank offers free policies.

These fees are not fixed; they are reference values. In practice, the fee may be lower, as in my test.

If prompted “Authentication tool does not support this transaction,” just enable the Mobile Shield according to instructions.

For recipient account information, pay attention to the recipient account number. For iFast, copy the IBAN, usually available in bank details. Copy-paste is recommended to avoid errors.

After filling, confirm and submit.

After confirming, click Next. Special situations may arise: my purchase purpose was Overseas Shopping, but here Computer Services was selected, causing inconsistency. It must be modified to match.

Click to modify purpose.

Preview the application and enter the password to complete submission.

I submitted on Friday afternoon; the next two days were the weekend, so no processing occurs. Just wait.

On Monday, I opened the Bank of China app and saw that the funds were remitted, but iFast had not yet received them.

In the afternoon, the funds were received.

The received amount was 88 GBP instead of 100 GBP, indicating a 12 GBP fee, or 12% fee rate. For small amounts, the fee proportion looks high. For large payments like tuition, the proportion is lower.

This completes the process. It is simple, and processing is fast. Excluding weekends, it takes about one day to remit and arrive.

If submitted in the morning, funds could arrive in the afternoon. A friend tested sending 10 GBP in the morning, and it arrived the same afternoon, even after modifying the remittance purpose. Efficiency is very high.

A: Each individual has a quota equivalent to USD 50,000 per calendar year.

A: Yes, you can remit USD, GBP, and other supported currencies regardless of the destination country.

A: Typically one business day, excluding weekends.

A: You can find them in the recipient bank’s app or the recipient will provide them.

A: Yes, fees may include service fees, telecommunication fees, and cash/transfer difference. The actual fee may vary.

A: Yes, by selecting “Yes” when prompted, you pay the fees and the recipient receives the full remittance amount.

A: Modify the purchase purpose to match the remittance purpose before submission.

That's the end — thanks for reading!

Here are some communities created by Arthur. Feel free to join if you're interested:

The Telegram groups have fewer chat restrictions. Just add the bot and select the type of community you'd like to join:

You can also add Arthur as a Telegram contact:

Connect with Arthur and stay closer.

Disclaimer: The content of this article reflects personal opinions only. Any financial actions taken based on this information are at your own risk, and any resulting losses shall be borne solely by the operator.