加群或其他问题可扫二维码添加阿瑟

加群或其他问题可扫二维码添加阿瑟

Discover how to use Wise (formerly TransferWise) for cross-border payments. Learn about multi-currency accounts, low fees, fast transfers, Alipay/WeChat withdrawals, and how to register from Mainland China.

“Smart Payments Start with Wise” — The Ultimate Guide for Cross-Border Side Hustle & Global Income

Arthur has previously written many guides on opening Hong Kong bank accounts. But since we are aiming for a cloud resident lifestyle, this time let’s talk about other channels, beyond HK bank cards, that allow us to receive overseas income.

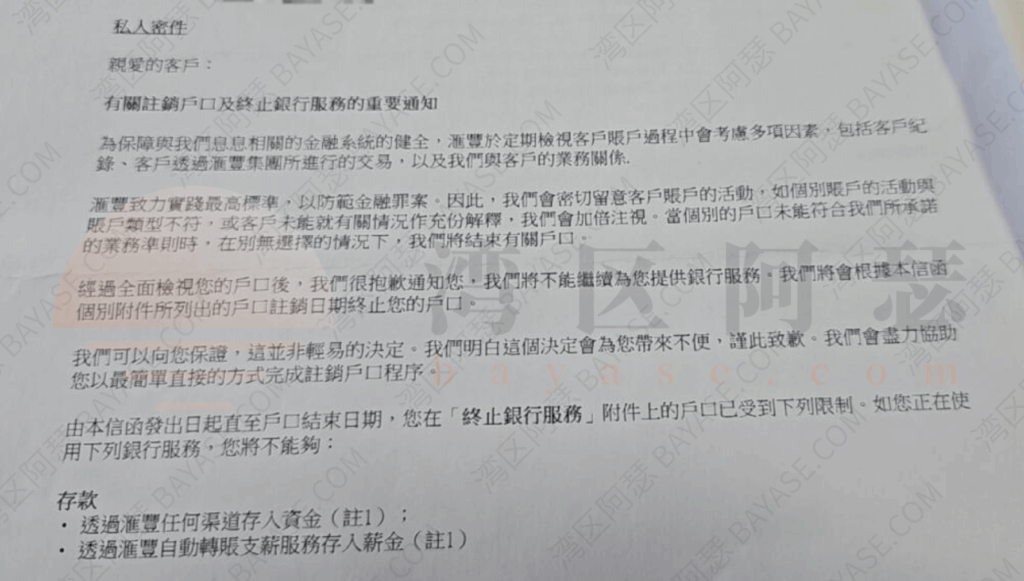

For those who follow Arthur closely, you know I don’t really recommend using HK bank cards to receive international income. Why? Because it’s too easy to trigger account reviews and risk sudden account closure.

So, if we want a reliable way to secure our financial foundation as cloud residents, we must prepare ahead. Otherwise, what’s the point of earning money if we can’t even receive it?

If you are still struggling with cross-border payments, frustrated by slow withdrawals, high fees, and delays—then this guide is for you.

Wise (formerly TransferWise) is currently one of the best solutions for Mainland Chinese users doing cross-border side hustles. It offers free application, multi-currency accounts, instant transfers, the lowest fees worldwide, and 0 annual fee virtual accounts + debit cards. Truly a must-have tool for cross-border income.

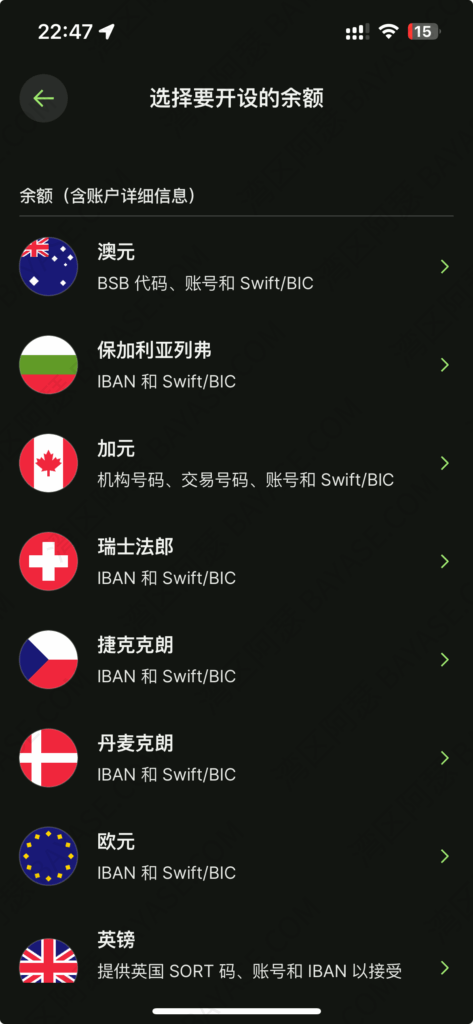

Wise supports more than 50 currencies worldwide. From major ones like USD, EUR, GBP, AUD, CNY, to smaller currencies like the Bulgarian Lev—almost everything is covered.

Even HSBC One in Hong Kong only supports 12 currencies. Wise far surpasses that.

If you’re receiving money from the US, simply share your Wise USD account. The sender won’t need to use international wire or SWIFT, just a local transfer.

That means faster, cheaper, and much less hassle.

Wise charges cross-currency transfer fees as low as 0.4%, and money usually arrives within seconds.

Compared to traditional banking, there’s no need to exchange currency separately before sending. Everything is automatic.

China’s “Cross-Border PayLink” also offers instant transfers, but it only supports CNY ↔ HKD, while Wise covers dozens of currencies.

(⚠️ Note: Mainland Chinese users currently cannot apply for Wise cards.)

Some users try to bypass this by using overseas addresses, but for long-term use, this is risky. If you just want to collect cards, feel free—but don’t rely on this method for serious finances.

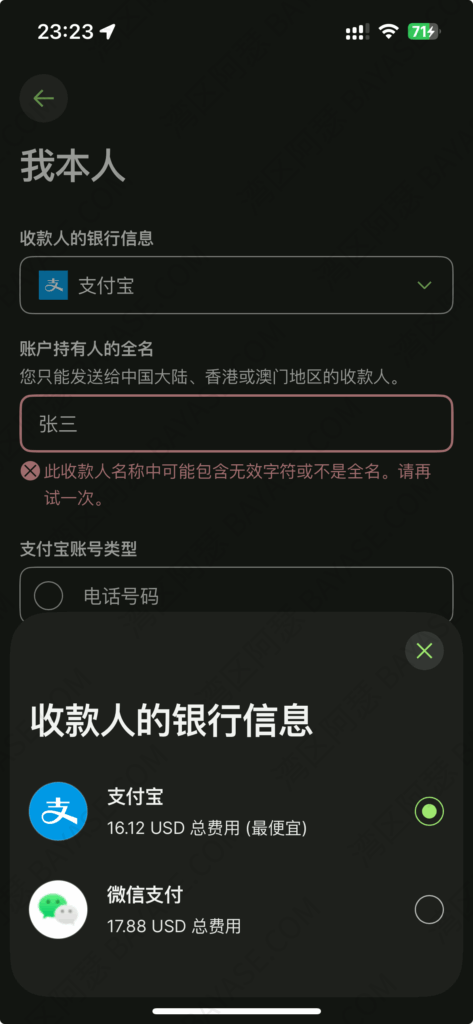

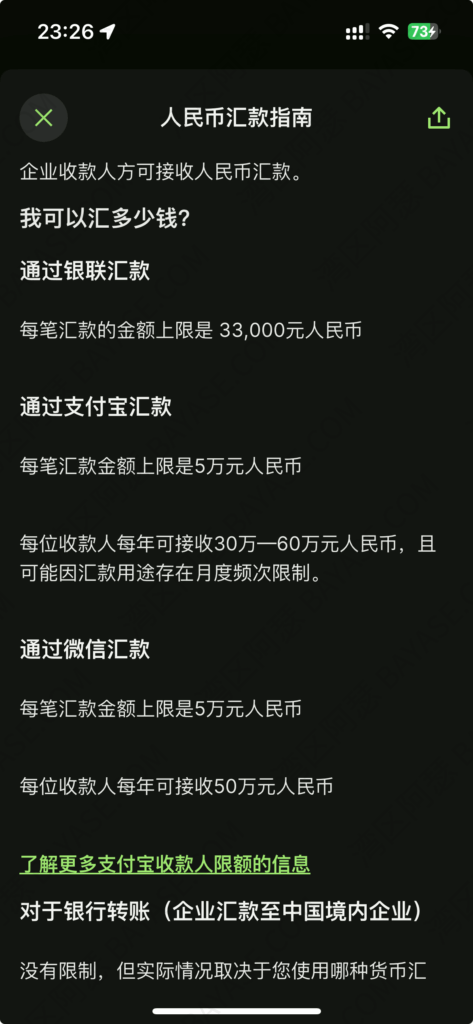

Wise allows you to transfer CNY directly to Alipay or WeChat Pay.

⚠️ But keep in mind: there are annual transfer limits for Alipay/WeChat withdrawals. Wise will clearly show these caps.

| Account Type | Features | Suitable For |

|---|---|---|

| Personal | Multi-currency balance + virtual/debit card + cross-border transfer | Freelancers, digital creators, e-commerce sellers |

| Business | Corporate account + bulk payments + API integration | Teams, shops, enterprises |

For most of us, a personal account is enough. Business accounts are harder to open (require a business license, etc.).

⚠️ Note: Mainland users cannot use Wise debit/virtual cards and cannot access investment features.

You can directly use your Wise local accounts (e.g., USD, EUR, GBP) to receive overseas income.

Example: Freelance clients in the US can pay you via ACH to your Wise USD account—no wire fees, no delays.

(👉 Detailed USD account tutorial will be shared separately.)

Yes, supports ID/Passport KYC.

No, both account and virtual card are free.

Cross-currency: a few minutes. To China: within 30 minutes.

Mid-market rates, low fees (from 0.4%).

Single transfer up to ¥100,000 CNY (depending on ID + tax records).

No, card application is unavailable.

If you urgently need a cross-border payment solution, I strongly recommend opening a Wise account now. Mainland Chinese ID is enough to register.

Even if you only plan to expand into side hustles later, having a Wise account ready ensures you won’t miss out when the time comes.

👉 Open Your Wise Account Today

That's the end — thanks for reading!

Here are some communities created by Arthur. Feel free to join if you're interested:

The Telegram groups have fewer chat restrictions. Just add the bot and select the type of community you'd like to join:

You can also add Arthur as a Telegram contact:

Connect with Arthur and stay closer.

Disclaimer: The content of this article reflects personal opinions only. Any financial actions taken based on this information are at your own risk, and any resulting losses shall be borne solely by the operator.